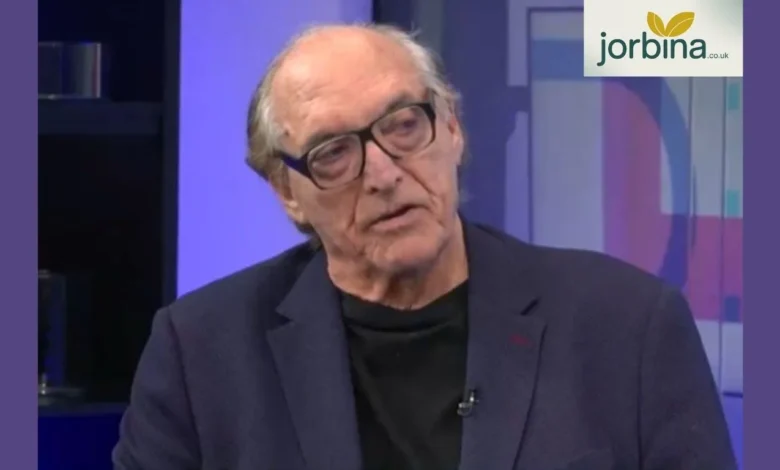

Inside Roger Gewolb’s Bold Approach to Finance

What makes someone step into the complex world of finance not to chase profit but to challenge how it works? Why would a person spend decades pushing for fairness in a system built to protect its own interests? That’s where Roger Gewolb stands out. His journey is one part finance, one part advocacy, and one part courage. He doesn’t fit neatly into the boxes of banker, activist, or politician, yet he has played pieces of all three roles. Let’s walk through his story, his ideas, and why his work still sparks discussion today.

Early Life and Nationality

The roots of an advocate

Roger Gewolb was born in August 1943 and is American by nationality. His professional and personal life eventually brought him to the United Kingdom, where he’s lived and worked for many years. While little is publicly known about his early childhood or education, what’s clear is that his curiosity about fairness in finance shaped his path. Over time, he developed into a thoughtful yet outspoken figure who believes that ordinary people deserve a financial system that treats them with honesty.

Dr Roger Gewolb’s background

His name often appears with the title “Dr”, though there are few public details about the field of study or institution where he earned it. What we do know is that by the 1970s, he had already begun carving a place for himself in the finance world. He started his UK career after working in the United States, bringing with him both business instincts and a sense of social responsibility. Unlike many in his field, he didn’t limit himself to numbers; he focused on the people behind them.

Professional Journey

From merchant banking to consumer finance

Roger Gewolb’s early professional steps took him from merchant banking in Chicago to London, where he founded Investors Lease Management Ltd in 1974. A few decades later, he took a major leap by buying British Credit Trust Ltd from the Bank of Ireland in 1994. That move marked the start of his deep dive into consumer credit, vehicle financing, and personal lending. His goal wasn’t only to build a successful company but also to offer financial products to people often ignored by traditional banks.

Creating movements that matter

By 2012, he had shifted his focus toward advocacy and founded the Campaign for Fair Finance (CFF). The campaign challenged the widespread exploitation of financially vulnerable people following the global financial crisis. It demanded greater accountability from lenders and called for a credit system that valued transparency. His next major step came in 2015 when he launched FairMoney.com, a platform that helps consumers compare lending options and avoid predatory financial products. This combination of advocacy and innovation positioned him as both a reformer and an entrepreneur.

What Drives His Mission

Philosophy of fairness

For Roger Gewolb, finance isn’t only about numbers and risk—it’s about fairness. He believes that the lending system should empower people rather than trap them. He often describes financial fairness as a cornerstone of a healthy economy. His work through FairMoney and the Campaign for Fair Finance reflects that principle. He doesn’t speak in technical jargon or distant theory. He speaks in plain terms about people struggling with debt and the real consequences of an unjust system.

Blending business and activism

What separates him from most industry figures is his willingness to work inside and outside the system. On one hand, he’s a businessman who understands profit margins and balance sheets. On the other hand, he’s an advocate who talks about ethics and justice. He uses media appearances, interviews, and policy discussions to push for reform. That mix of credibility and conviction makes him one of the more unusual voices in British finance.

The Making of a Thought Leader

The big moments

His impact isn’t just in what he says but in what he builds. Through the British Credit Trust, he opened credit channels to thousands who couldn’t access traditional loans. With the Campaign for Fair Finance, he helped spark a national debate about payday loans and high-interest lending. With FairMoney.com, he created a consumer tool designed to level the playing field. He’s also advised institutions such as the Bank of England and the UK Treasury, further cementing his influence in shaping finance policy.

How his voice carries weight

Roger Gewolb’s influence stretches across media and politics. He appears on outlets like GB News to discuss the economy, regulation, and consumer rights. His communication style is direct, often challenging industry norms. He doesn’t hide behind legal terms or abstracts. Models—he explains how policies affect everyday lives. That clarity has made him a trusted source for those who want to understand how finance connects to fairness.

The Man Behind the Mission

Roger Gewolb’s identity and beliefs

Public information about his religion is limited. He has not formally declared an affiliation, preferring to let his values, integrity, justice, and compassion speak for themselves. His focus remains on moral fairness in finance, not theological doctrine. When people ask about his nationality, the answer is simple: Roger Gewolb is American. He has lived in England for decades, but his nationality remains unchanged. As for his height or other personal statistics, no verified public data exists.

What makes him relatable

Part of his appeal is that he doesn’t sound like a corporate executive. He sounds like someone who genuinely wants things to work better. He admits to mistakes, such as hesitating too long before launching his company, but he learns from them. That human side, his willingness to reflect and adapt, makes his story easier to connect with.

Understanding His Bold Approach

Challenging old systems

When Gewolb entered the subprime finance space, it was largely viewed as high-risk and low-status. But he saw an opportunity in helping those left out by conventional lenders. Instead of chasing high-end clients, he turned to those with imperfect credit histories. This shift was not just smart business; it was a statement. He argued that financial access is a right, not a privilege.

Linking fairness to reform

His ideas resonate even more today as discussions around consumer rights and finance reform intensify. For example, debates such as ‘Why the Car Finance Supreme Court Decision Is a Game-Changer‘ highlight how consumer justice continues to evolve. Gewolb’s long-standing advocacy for fair lending directly ties into these movements. He was calling for such changes years before they reached the courts or headlines.

Influence in Modern Finance

How his work fits today

With the rise of fintech, buy-now-pay-later schemes, and algorithm-driven credit scoring, fairness in lending has become even more complicated. Gewolb’s principles, transparency, accessibility, and accountability, feel more urgent than ever. His work through FairMoney continues to provide practical tools that let consumers make informed decisions.

The wider conversation

Financial fairness is now part of broader social and political discussions, and Gewolb’s efforts helped bring it there. Other platforms and publications, such as Jorbina, continue to explore related issues, reinforcing the kind of transparency he has long promoted. His consistent voice across media and policy proves that advocacy doesn’t end once awareness grows; it evolves.

Looking Ahead

The future of fair finance

Gewolb will likely keep working at the intersection of business and advocacy. With cost-of-living pressures and ongoing scrutiny of lenders, his focus on consumer protection could grow even more relevant. FairMoney may expand into fintech innovation, integrating technology with ethical lending principles. And as policymakers revisit credit regulations, his expertise will remain valuable.

Lessons worth noting

From his journey, a few takeaways stand out: move with conviction, question accepted norms, and remember that fairness is profitable when done right. His mix of business insight and human empathy shows that reform doesn’t mean rejecting success; it means redefining it.

Facts Summary: Roger Gewolb Wiki

Dr Roger Gewolb, Wikipedia: No dedicated Wikipedia page currently exists, but multiple media outlets have profiled his work.

Roger Gewolb Religion: Not publicly stated; he tends to express moral rather than religious motivations.

Dr Roger Gewolb Nationality: American, resident in England.

Roger Gewolb, American: Confirmed through UK Companies House records.

Dr Roger Gewolb Height: No public data available.

FAQs

Who is Roger Gewolb?

He is an American financial entrepreneur and consumer rights advocate known for founding the Campaign for Fair Finance and FairMoney.com. His work focuses on improving transparency and fairness in the lending industry.

What is Roger Billings known for?

Roger Billings is a different individual, recognised for his contributions to technology and education, not related to Roger Gewolb’s field.

What is the criticism of Acellus?

Acellus, an online learning platform, has been criticised for inconsistent academic quality and limited oversight, issues unrelated to Gewolb’s finance work.

What happens if you miss a science live on Acellus?

Students typically watch a recorded session or complete equivalent coursework; policies vary by school.

Who invented the first hydrogen car?

Early hydrogen vehicle development involved multiple inventors, but General Motors and later Toyota are credited with the first practical fuel-cell prototypes.

Roger Gewolb’s career continues to show that finance doesn’t have to be cold or distant. It can be a force for fairness, a space where ethics and numbers meet. His story reminds us that the system changes only when people inside it decide to make it better.