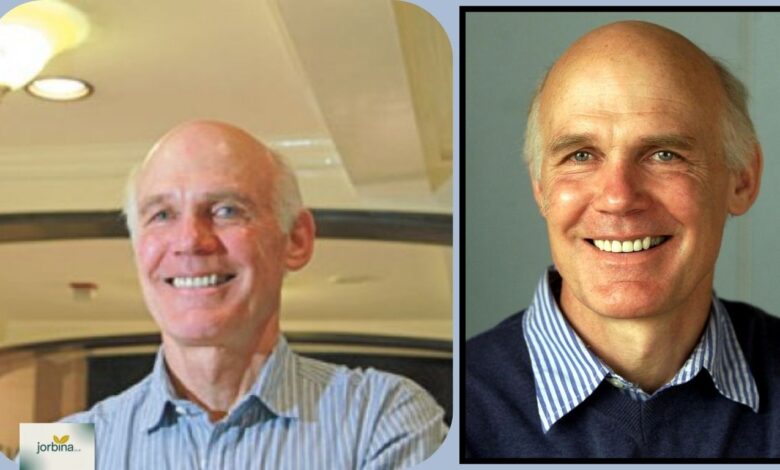

Why Robert Wade Economist Thinks the Economic Game Is Rigged

If you’ve ever sensed that the global economic system isn’t quite fair, where certain players consistently win while others struggle, that’s a sentiment Robert Wade shares. As a development economist deeply concerned about inequality and power imbalances, he argues that the rules of the economic “game” are not neutral. Instead, they’re skewed by institutions, policies, and power structures favoring dominant nations and corporations. Wade’s view isn’t a complaint from the fringes; it’s a well-researched critique grounded in decades of study and global observation.

Wade doesn’t dismiss markets as inherently bad; rather, he insists that markets alone don’t guarantee fair outcomes. The game is rigged not through conspiracy, but structural design. Global institutions like the IMF, World Bank, and World Trade Organization often impose policy templates focused on free markets and liberalization, templates that look neat on paper but can undermine development in weaker economies. For Wade, recognizing the skew is the first step toward reform.

Understanding the Roots of the Rigged Game

At the heart of Wade’s argument lies a powerful myth: that free markets automatically yield growth, fairness, and prosperity. But Wade noticed this wasn’t happening in many parts of the world. In Governing the Market (1990), he showed how East Asian economies, South Korea, Taiwan, unlocked explosive growth through strategic government involvement, not market purity. By using tariffs, subsidies, and selective industrial policy, these states navigated markets smartly, mixing vision with pragmatism.

This model, Wade argues, illuminates how economic policy can be transformative—but only when tailored to local contexts. The standard Western playbook, emphasizing minimal state interference and rapid liberalization, often backfires in developing economies. Without strong institutions and a clear industrial strategy, markets may entrench inequality rather than reduce it. In Wade’s world, fairness isn’t given; it’s shaped.

How Institutions Help Rig the Game, and How They Could Unrig It

Part of Wade’s compelling critique centers on the roles played by global institutions. The IMF and World Bank, for example, often promote structural adjustment policies: cuts in public spending, rapid trade liberalization, and financial deregulation. While well-intentioned in theory, these reforms can erode state capacity, weaken social protection, and open economies to volatile capital flows. These aren’t conspiracies, they’re institutional norms that often favor established powers.

That’s why Wade advocates for policy space, allowing states to intervene strategically in their economies without fear of being penalized by global institutions or capital markets. For deeper context, the Peterson Institute for International Economics offers thoughtful research on the delicate balance between state roles and global integration, and how policy space matters for development: Peterson Institute on Globalization.

When powerful institutions reshape how economies operate, they fundamentally shift the game. Wade’s call is simple: if playing fair matters, then reshaping institutions to allow fairer play matters even more.

Examples of a Rigged Economic Game in Action

When free trade agreements protect agriculture in rich nations but demand liberalization from poorer ones, the imbalance is structural. Similarly, intellectual property regimes can privilege multinational corporations, limiting access to medicine or technology in low-income countries. Then there’s capital liberalization, welcomed for investment inflows, but dangerous when hot money exits rapidly, crashing markets. These are real-world instances of how the game is rigged by design.

Wade uses concrete case studies, whether in Latin America or Asia, to illustrate how policies mandated from the outside can shatter local economic plans. Without institutional safeguards or flexibility, countries lose the ability to nurture industries, protect jobs, or invest in infrastructure. For Wade, development economics isn’t abstract; it’s about protecting livelihoods and futures.

Robert Wade Economist in Action: A Video Primer

Here’s a compelling lecture where Robert Wade lays out his perspective with clarity and energy:

This talk captures his central thesis: markets matter, but smart governance matters more. If you’re looking for an engaging introduction to Wade’s thought, this is it.

Why Wade’s Perspective Matters More Today

Inequality is soaring, global integration is under scrutiny, and climate shocks are hitting fragile economies hard. In this turbulent era, Wade’s insistence on policy space and state strategy is more relevant than ever. His critique doesn’t seek to shut markets down; it calls for them to be fair, accountable, and supportive of inclusive growth.

As the world grapples with de-globalization, supply-chain realignment, and rising tariff walls, Wade’s perspective reminds us that a blank slate economy doesn’t lead to progress. What’s needed is an intelligent mix of market openness and state capacity. Without that, the economic game continues to favor the already powerful.

Facing the Critics, And Why the Conversation Still Matters

Not everyone agrees with Wade. Critics argue that state intervention leads to inefficiency, rent-seeking, or corruption. They point to development failures in parts of Latin America or Africa as evidence. Yet Wade counters that the issue isn’t intervention per se, but how—and when—it’s applied. In East Asia’s success stories, governments worked with business, preserving flexibility while maintaining oversight.

Others say global coordination matters more than local protectionism—especially in an interconnected, digital world. Wade acknowledges that, but argues for balance: coordination shouldn’t mean uniformity. Context matters too much, and poorly timed liberalization can disrupt rather than develop.

FAQs

Who is Robert Wade in political economy?

A development economist and professor at LSE, best known for challenging neoliberal orthodoxy and promoting state-led industrial policy.

Who is the famous economist Robert?

There are many: Robert Solow (growth theory), Robert Lucas (rational expectations), Robert Mundell (currency zones), which one depends on the context.

Which economist wrote A Treatise on Political Economy?

Jean-Baptiste Say, a 19th-century French economist, authored A Treatise on Political Economy.

Who is called the father of political economy?

Adam Smith is widely regarded as the father of political economy, thanks to his seminal work The Wealth of Nations.

Who is the founder of Way of Wade?

NBA star Dwyane Wade founded the sports fashion brand “Way of Wade” in collaboration with Li-Ning.

Final Thoughts, Rewriting the Game Together

We often talk about “changing the rules” without seeing how deeply those rules are embedded. Robert Wade economist, shines a light on the structures that govern the global economy, not malicious conspiracies, but systemic designs. And by diagnosing structural unfairness, he offers a path forward: more nuanced policy, democratic accountability, and institutional reform.

If the game is rigged, the work ahead is not to throw out markets, but to remake the playing field. That’s Wade’s message, and it deserves to be part of our collective conversation. Let me know if you want deeper dives into his case studies, comparisons with other development economists, or ideas for applying his insights in policy debates.